In today’s business, I often hear stories about businesses—whether small startups or established companies—getting stuck because of poor documentation. Running a business is challenging enough without extra tasks, and keeping up with paperwork might feel like a chore. Yet, solid documentation is a key part of a successful business strategy. It’s crucial for everything from staying compliant with laws to keep operations running smoothly.

Truth is, you could own a business empire but the lack of one key factor; documentation can ruin your business and make you miss opportunities. So, that is why I’ll guide you through why business documents are so valuable. We’ll look at why creating and keeping accurate records is essential, and we’ll go over some of the main types of business documents you’ll want to prioritize.

By the end, I’ll also provide tips on which records are essential to keep your business in top shape.

What are business documents?

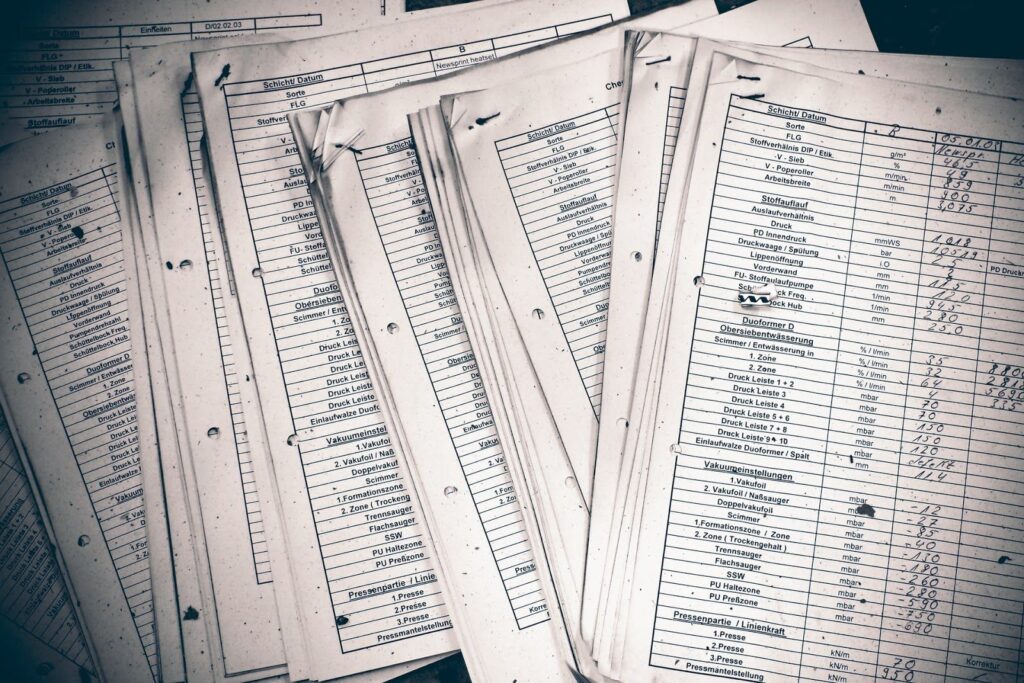

Business documents are important records that capture key information about what goes on in your company—your activities, transactions, and goals. These documents can take many forms, like contracts, invoices, employee agreements, financial reports, and meeting notes. Each one plays its part in helping your business function and grow, even if we don’t always notice it.

They act as dependable references, making it easy to look back at performance, make better decisions, and communicate clearly. Some of these documents are required by law, like tax forms, while others—such as marketing plans or inventory logs—are for internal use to boost productivity and give insight into operations.

Why is it important to produce business documents?

Creating and keeping business documents may seem like just a routine task, but it’s much more important than it appears. Let’s dive into why these documents are vital for a successful business:

Legal compliance

Every business needs to follow certain laws, whether it’s about taxes or employee rights. Legal documents, such as tax returns, employee contracts, and business registration papers, help us stay on track with local, state, and federal regulations. If these documents aren’t in order, businesses can face penalties, fines, or even lawsuits.

Better organization and efficiency

Business documents help us keep everything in order. Think about trying to verify a payment or review a contract. Having a well-organized system makes these tasks quicker and avoids any confusion. When your documents are organized, your business runs more smoothly and responds faster.

See: Leverage in Business: How to Scale Without Overstretching Resources

Managing finances and staying accountable

Invoices, receipts, and financial reports are key to handling money, planning budgets, and predicting future financial needs. These documents let us see where money is going, how much we’re earning, and where we’re losing money. They also play a crucial role when we need to show how the business is doing to investors or stakeholders.

Informed decision-making

Business documents are a goldmine of past data and insights, which are vital for making smart decisions. Annual reports, performance reviews, and customer feedback help us identify patterns and make choices based on facts, not guesswork. Without these records, we’d be taking shots in the dark when making important decisions.

Clear communication and transparency

Good communication with employees or clients relies on clear and accurate documents. Contracts and agreements that are properly signed help avoid confusion and keep everyone on the same page. Whatever it is with setting clear expectations for a project or outlining employee responsibilities, having everything documented removes uncertainty and keeps things running smoothly.

What are business-required documents?

There are various business documents, some legally required, and others important for smooth operations. Here’s a breakdown of key document types you should be aware of:

Legal Documents

- Business Registration: This document proves your business is officially registered and recognized as a legal entity.

- Permits and Licenses: Certain industries, like food services or retail, require specific permits to operate legally.

- Contracts and Agreements: These include important documents such as partnership agreements, employee contracts, and lease agreements for your business premises. They clearly state the responsibilities of everyone involved and offer protection in case of disputes.

Financial Documents

- Tax Returns: Filing tax returns is a legal obligation for all businesses, and this requires keeping proper records of income and expenses.

- Invoices and Receipts: These documents track the flow of money into and out of the business, helping with accurate financial records.

- Balance Sheets and Profit & Loss Statements: These reports offer a clear picture of the business’s financial health by summarizing assets, liabilities, income, and expenses.

Operational Documents

- Employee Records: These documents include details like employee contracts, performance reviews, and payroll information to help manage staff effectively.

- Inventory Records: Essential for businesses that sell physical products, these records track stock levels, helping to prevent shortages or excess inventory.

- Marketing Plans: Though not required by law, these plans outline promotional strategies, help track progress, and guide future marketing efforts.

Compliance Documents

- Insurance Certificates: Proof of insurance is often necessary for businesses, and these certificates should always be on hand to show coverage.

- Safety Manuals and Compliance Records: Especially important for businesses in industries like manufacturing or construction, these documents ensure that safety regulations are followed and employees are protected.

What documents do I need to keep for my business?

Knowing which documents to keep and for how long can be confusing, but it’s crucial to ensure compliance and prevent headaches down the road. Here are some key documents you’ll want to keep for your business:

- Tax documents and financial records: Tax documents, like tax returns, income records, and receipts for deductible expenses, should be kept for at least seven years. Financial records, including profit-and-loss statements and balance sheets, are also essential for reviewing past performance and handling audits smoothly.

- Employee and HR records: For employees, keep essential records like contracts, payroll details, and performance reviews. Maintain files for active employees and keep documents for former employees for at least seven years after they leave.

- Contracts and legal agreements: Hold onto contracts with clients, suppliers, and partners for the entire contract term and several years afterwards in case any issues arise. Important legal documents—like insurance policies and lease agreements—should also be stored safely.

- Operational and sales records: Inventory logs, customer invoices, and purchase orders help in managing daily operations. Sales records are valuable for tracking revenue patterns and planning for the future. Keeping these for a few years can also be helpful for any financial reviews or audits.

- Business plan and strategy documents: Though not required by law, storing your business plan, marketing strategies, and project details supports long-term planning. These documents provide a roadmap for growth and let you track your company’s progress over time.

Read this: Practical Budgeting Tips: How to Save Money on a Low Income

Scorecard Questions on Business Documents (Pdf.)

Also, see: How Debt Management Plans Work: Key Features, Pros and Cons (Plus Success Stories)

Frequently Asked Questions

Why is it important to keep business documents organized and accessible?

Keeping business documents organized allows for quicker access, reduces errors, and enhances productivity. Organized records make it easy to track financial performance, address legal inquiries, and manage operations smoothly.

How do business documents help with legal compliance?

Legal compliance often requires specific documentation, such as permits, tax records, employment agreements, and insurance certificates. These documents prove that your business adheres to laws and regulations at various levels, reducing the risk of fines, penalties, or lawsuits.

How can digital solutions help with managing business documents?

Digital solutions, such as document management software, make it easy to store, organize, and retrieve records. They can automate workflows, facilitate collaboration, ensure version control, and provide security features like encryption.

What is a document retention policy, and why is it important?

A document retention policy defines how long a business should keep each type of document. This policy is important because it ensures legal compliance, reduces storage costs, and simplifies document management. By establishing retention periods, you can discard outdated documents responsibly and focus on maintaining only essential records.

Conclusion

When running a business, documents might seem like a low priority. But as we’ve discussed, these records carry more weight than just filling up files. They keep us legally safe, support better decisions, track finances, and keep our operations smooth. By actively organizing our business documents, we’re not only lowering risks but also setting up a strong base for steady growth and flexibility.