The Power of Leverage in Business: Strategies for Success

Have you ever wondered why some businesses seem to succeed so effortlessly while others struggle despite their hard work? The key often lies in one essential idea: leverage. Leverage in business is like finding the magic tool that makes success easier to achieve.

It’s similar to using a lever to lift something much heavier than you could with just your strength. To put it simply, it’s not about putting in more effort, but about working in a smarter way.

By using leverage to streamline your business operations and boost profits, you can push your business to new levels of success. Let’s see all there is to it in this article.

What is Leverage in Business? An Example

Leverage in business is all about making the most of your resources; be it money, people, or technology—to get better results without putting in more effort. It helps you achieve more by doing less, allowing your business to grow faster and more efficiently.

Take a small retail business, for instance. Instead of juggling everything yourself, like handling inventory, customer service, and sales, you decide to bring on an assistant. By handing off the routine tasks to them, you now have more time to focus on the bigger picture—like finding new customers, improving your products, or creating marketing strategies. This is leverage in action. You’re not necessarily working harder but using someone else’s help to push your business forward.

Leverage isn’t just about hiring help—it can also involve finances. Let’s say you take out a loan to buy new equipment that speeds up your production. This is another form of leverage, called financial leverage. The real trick is knowing how to use the different types of leverage to grow your business smarter, not harder.

How Important is Leverage in Business?

Leverage is one of the most powerful tools in business, and it’s used by many successful companies like Apple, Amazon, and even smaller businesses that have grown quickly. It’s often the key difference between a company that stays small and one that expands in a big way.

From my own experience, I realized that using leverage completely shifted my mindset about growth. Instead of just focusing on putting in more time and effort, I started thinking about how to work smarter by multiplying my efforts. Leverage helps you grow your business without pushing yourself to the limit or stretching your resources like time, money, or energy too thin.

By tapping into outside resources, businesses can grow faster, lower their risks, and build a strong foundation for long-term success. For example, if you’re a startup with limited funds, partnering with a bigger company can give you access to tools, knowledge, and opportunities that you might not have on your own. This way, you can grow quicker without bearing the full financial burden.

Read: 8 Expert Tips on How to Promote Your Business Locally

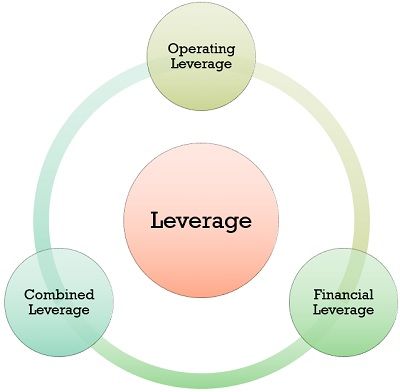

What are the Three Types of Leverage in Business?

The three types of leverage we have are as follows:

Financial Leverage

Financial leverage is when businesses use borrowed money to increase the potential return on their investment. It’s like in real estate—if I take out a loan to buy property, I only put in a little of my money, and the rest is borrowed. If the property value goes up, I make a bigger profit because I don’t rely only on my cash. But here’s the catch: if things don’t go as planned and the investment doesn’t perform well, I still have to pay back that loan.

In business, financial leverage can help with expanding, buying new equipment, or investing in technology. The key is to make sure the returns you get from borrowing are greater than the cost of the loan. It’s a balancing act between taking on debt and making sure the rewards are worth it.

Operational Leverage

Operational leverage is all about how much a business can use its fixed costs to make more money. For companies with high fixed expenses, like those in manufacturing, they can take advantage of producing more items without raising their costs.

This is called economies of scale—when you make more products, the cost per unit goes down, which boosts your profits. The more efficiently you run your operations, the more revenue you can generate without significantly increasing costs.

Take a consulting business, for example. If you have steady costs like rent, utilities, and a salaried team, those expenses don’t change no matter how many clients you take on. So, the more clients you serve, the higher your profits grow, because your fixed costs stay the same, but your revenue keeps going up. This is a great example of how operational leverage can work in your favour.

Combined Leverage

This is a blend of both financial and operational leverage. This approach helps us get a complete picture of how our decisions affect a company’s profits, risks, and overall stability. It’s about understanding how changes in sales can influence both our risk and our profit potential.

The degree of combined leverage (DCL) is a handy measure that shows how these factors interact. To find the DCL, we take the degree of operating leverage (DOL) and multiply it by the degree of financial leverage (DFL). A high DCL means there’s more risk, but also the chance for bigger returns if sales change.

Getting a grasp on combined leverage is crucial for making smart business choices. It helps us understand the overall risk and potential reward of our decisions, making it easier to plan both financially and operationally.

See this: Expert Insights: The Best Change Management Models for Achieving Business Success

How Do Businesses Build Leverage?

Building leverage is a smart strategy that takes careful planning to succeed. Here are a few ways I’ve found businesses can effectively build leverage and grow:

1. Delegate and Outsource

One of the easiest ways to create leverage is by assigning tasks to others. This might mean hiring staff, working with freelancers, or teaming up with other companies to share the workload. From my personal experience, I realized that trying to do everything on my own held my business back. But once I started handing off tasks to others, it gave me the time to focus on more important things, like planning and building relationships.

2. Use Technology to Automate

Using technology can completely change the game for a business. By automating tasks that are done over and over, you free up time to focus on bigger and more important things. For example, I can use email marketing tools to send personalized messages to thousands of customers automatically, or I can schedule social media posts in advance to save time.

By choosing the right technology tools, you can grow your business without having to hire more people. This keeps your costs low and boosts profits, thereby helping you scale much faster.

3. Leverage Financial Capital

Financial leverage lets businesses grow, even if they don’t have enough money upfront. For example, if you wanted to expand into a new market or buy better equipment, you could take out a loan to make it happen. This kind of leverage can give your business a serious boost. But you have to be smart about it—too much debt could weigh your business down.

Another option is equity financing, which is where investors come in. They would provide the money you need to grow, but in return, they’d own part of the business. It’s a great way to raise funds without getting into traditional debt, but it does mean sharing control.

4. Build Strategic Partnerships

Forming partnerships is another great way to gain leverage in business. By working with other companies, influencers, or organizations, we can tap into new markets, resources, and skills. These partnerships allow us to grow more quickly by using the strengths of others, so we don’t have to build everything from the ground up.

For instance, if I run a tech startup, teaming up with a bigger company could give me access to their customers, marketing tools, and technology. This kind of partnership can speed up growth and open doors that would have been tough to access on my own.

5. Use Intellectual Property

Intellectual property like patents, trademarks, or unique software is a powerful tool for gaining an edge in business. When we own something distinctive, it helps us set ourselves apart from competitors and grab special opportunities in the market.

For example, if I create a new technology that innovatively addresses a specific issue, I can use that intellectual property to either license the tech to other companies or sell my product at higher prices. This way, I not only protect my unique creation but also open up additional revenue streams and strengthen my market position.

Scorecard on Leverage in Business (Pdf.)

Here are some questions we have put together to help you decide if you are putting in your best to grow your brand.

Read also: Key Project Management Principles: Essential Principles for Business Growth

Frequently Asked Questions on Leverage in Business

Why is leverage important in business?

Leverage is crucial because it allows you to maximize your resources and achieve more significant growth without requiring a proportional increase in effort or investment. It helps businesses scale faster, increase efficiency, and enhance profitability by making the most out of available resources.

How can I effectively use financial leverage?

To effectively use financial leverage, start by assessing your need for additional capital. Consider taking out loans or seeking investments to fund growth initiatives. Ensure that the potential returns from the investment outweigh the cost of borrowing.

How can I build strategic partnerships to leverage my business?

Building strategic partnerships involves collaborating with other businesses, influencers, or organizations that complement your own. Look for partners who can offer resources, expertise, or market access that you don’t have. Establish clear goals for the partnership and ensure mutual benefits to maximize the leverage gained from the collaboration.

How can I measure the impact of leverage on my business?

To measure the impact of leverage, track key performance indicators (KPIs) such as revenue growth, profit margins, and return on investment (ROI). Analyze how different forms of leverage contribute to achieving your business goals and adjust your strategies based on the results.

Conclusion

By using financial tools, improving your operations, or tapping into technology, you can boost your efforts and propel your business forward. Understanding how important leverage is can truly make a difference. It’s often the factor that helps businesses thrive instead of just getting by.

When it comes to figuring out how to use leverage in your business, start with small steps. Look for ways to delegate tasks, automate processes, or make smart investments. This will help you save time and make better use of your resources, letting you focus on what matters.